Learning that you have cancer can be stressful and frightening. Knowing what to expect — from diagnosis to recovery — can empower you and help you take control of your health. This is a general overview of what cancer is, symptoms to watch for, how it’s detected, treatments and post-treatment care.

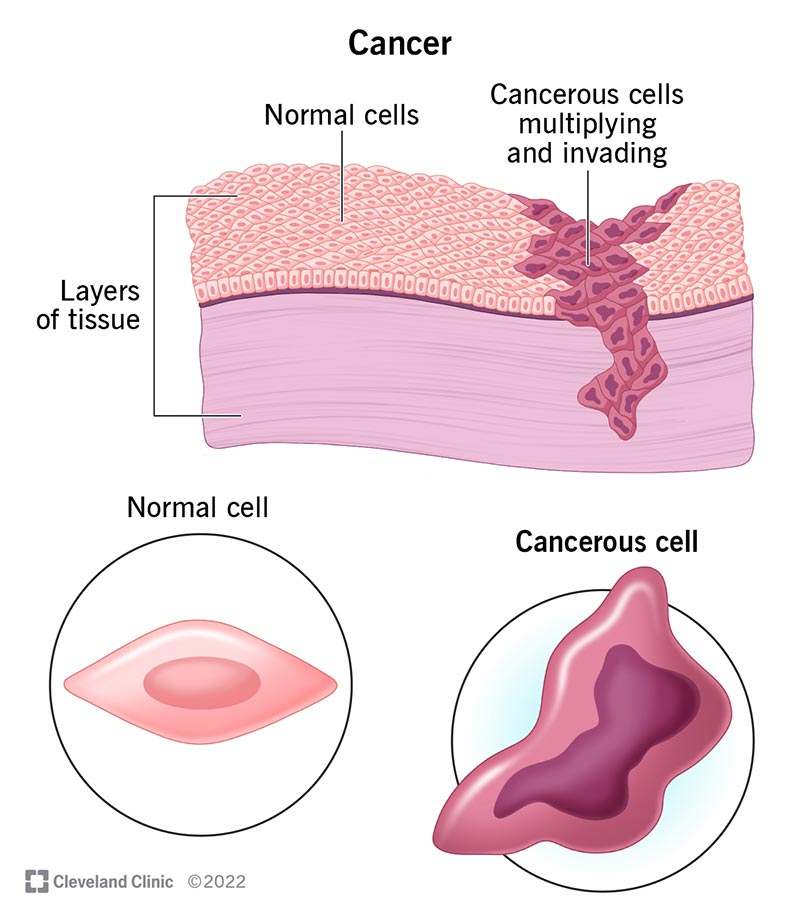

Cancer is a large group of diseases with one thing in common: They all happen when normal cells become cancerous cells that multiply and spread.

Cancer is the second most common cause of death in the U.S. But fewer people are dying of cancer now than 20 years ago. Early detection and innovative treatments are curing cancer and helping people with cancer live longer. At the same time, medical researchers are identifying independent risk factors linked to developing cancer to help prevent people from developing cancer.

Normally, cells follow instructions provided by genes. Genes set down rules for cells to follow, such as when to start and stop growing. Cancerous cells ignore the rules that normal cells follow:

Cancer starts when a gene or several genes mutate and create cancerous cells. These cells create cancer clusters, or tumors. Cancerous cells may break away from tumors, using your lymphatic system or bloodstream to travel to other areas of your body. (Healthcare providers call this metastasis.)

For example, a tumor in your breast may spread to your lungs, making it hard for you to breathe. In some types of blood cancer, abnormal cells in your bone marrow make abnormal blood cells that multiply uncontrollably. Eventually, the abnormal cells crowd out normal blood cells.

According to the American Cancer Society, 1 in 2 men and people assigned male at birth (AMAB) and 1 in 3 women and people assigned female at birth (AFAB) will develop cancer. As of 2019, more than 16.9 million people in the U.S. were living with cancer. The most common cancers in the United States are:

Almost anyone may develop cancer, but data show cancer cases vary based on race and sex. According to the 2022 Annual Report on Cancer, the disease:

Almost anyone may develop cancer, but it typically affects people aged 60 and older.

Cleveland Clinic is a non-profit academic medical center. Advertising on our site helps support our mission. We do not endorse non-Cleveland Clinic products or services. Policy

Cancer is a complicated disease. You can have cancer for years without developing symptoms. Other times, cancer may cause noticeable symptoms that get worse very quickly. Many cancer symptoms resemble other, less serious illnesses. Having certain symptoms doesn’t mean you have cancer. In general, you should talk to a healthcare provider anytime there’s a change in your body that lasts for more than two weeks.

Some common early cancer symptoms include:

Left untreated, cancer may cause additional symptoms, including:

Cancer is a genetic disorder. It happens when genes that manage cell activity mutate and create abnormal cells that divide and multiply, eventually disrupting how your body works.

Medical researchers estimate 5% to 12% of all cancers are caused by inherited genetic mutations that you can’t control.

More frequently, cancer happens as an acquired genetic mutation. Acquired genetic mutations happen over the course of your life. Medical researchers have identified several risk factors that increase your chance of developing cancer.

You can reduce your risk by changing some of your lifestyle choices:

Healthcare providers begin a cancer diagnosis by doing a comprehensive physical examination. They’ll ask you to describe your symptoms. They may ask about your family medical history. They may also do the following tests:

Blood tests for cancer may include:

Imaging tests may include:

A biopsy is a procedure healthcare providers do to obtain cells, tissue, fluid or growths that they’ll examine under a microscope. There are several kinds of biopsies:

Cancer may happen when a single gene mutates or several genes that work together mutate. Researchers have identified more than 400 genes associated with cancer development. People who inherit these genes from their biological parents may have an increased risk of developing cancer. Healthcare providers may recommend genetic testing for cancer if you have an inherited form of cancer. They may also do genetic testing to do therapy that targets specific cancer genes. They use test results to develop a diagnosis. They’ll assign a number or stage to your diagnosis. The higher the number, the more cancer has spread.

Healthcare providers use cancer staging systems to plan treatment and develop a prognosis or expected outcome. TNM is the most widely used cancer staging system. T stands for primary tumor. N stands for lymph nodes and indicates whether a tumor has spread to your lymph nodes. M stands for metastasis, when cancer spreads.

Most cancers have four stages. The specific stage is determined by a few different factors, including the tumor’s size and location:

Though stages one through four are the most common, there’s also a Stage 0. This earliest phase describes cancer that’s still localized to the area in which it started. Cancers that are still in Stage 0 are usually easily treatable and are considered pre-cancerous by most healthcare providers.

Healthcare providers may use several different treatments, sometimes combining treatments based on your situation. Common cancer treatments include:

Healthcare providers work to balance the treatment so it destroys cancer without harmful or lasting side effects. Even so, all cancer treatments have side effects. Some treatments cause side effects that last for years after treatment is completed. Many people benefit from palliative care that eases cancer symptoms and treatment side effects. The most common cancer treatment side effects are:

Right now, more people are being cured of cancer or living longer with cancer. In general, people with cancer who were diagnosed and treated before it could spread have a good outlook.

But you’re unique, and so is your cancer prognosis. Your healthcare providers will base your prognosis on factors such as:

Your overall health, the type of cancer that you have, its stage and how you respond to treatment all affect your prognosis.

Your healthcare provider is your best resource for prognosis information. They know your situation and they know you.

Survival rates are estimates based on the experiences of large groups of people who have different kinds of cancer. Like prognoses, cancer survival rates vary based on cancer type, stage and treatment. According to the most recent data from the National Cancer Institute, 68% of people with any kind of cancer were alive five years after their diagnosis.

Self-care is an important part of living with cancer. Some self-care suggestions include:

If you have cancer, you are a cancer survivor. Cancer survivorship starts the day you receive a cancer diagnosis and continues for the rest of your life. As a cancer survivor, you’re likely to experience many challenges or complications.

Sometimes, cancer treatment doesn’t eliminate all cancerous cells. Those cells can become new cancerous tumors. Cancer that comes back, or recurrent cancer, may appear at the same place as the original cancer, in nearby lymph nodes or spread to organs and tissues far away from the original site.

A second cancer is a new cancer. People who have second cancers may have cancer in the same organ or area of their body as the first cancer, but it’s a different type of cancer from what it was before. They may also have cancer in different areas of their bodies. Second cancers are more common, as more people live longer with cancer.

Cancer fatigue is an overwhelming sense of tiredness that isn’t helped by getting more rest. Some people have chronic cancer fatigue that continues after they’ve finished treatment.

Some cancer treatments have lasting side effects that may cause pain. One study found that 39% of people who completed cancer treatment had chronic pain. Peripheral neuropathy is an example of pain that may persist after treatment.

Chemotherapy brain fog (chemo brain) happens when cancer or cancer treatment affects your ability to remember or act on information. About 75% of people receiving cancer treatment tell their healthcare providers that they have issues with memory, concentration and their ability to complete tasks.

Talk to your healthcare provider about any issues you experience while you’re undergoing cancer treatment. Call your oncology team if you notice:

Knowledge is power. If you’ve been diagnosed with cancer, you’ll want to gather as much information as you can. Here are some questions to ask your healthcare provider:

The words “You have cancer” may be one of the hardest things anyone has to hear. Learning you have cancer might make you feel frightened and overwhelmed. Many people feel as if they’ve lost control of their lives. Your healthcare providers understand all of those feelings. They know a cancer diagnosis is a life-changing event. They also know cancer treatment is a stressful journey. If you have cancer, know that your providers will be with you every step of the way.

Last reviewed by a Cleveland Clinic medical professional on 11/08/2022.

Learn more about our editorial process.

Cleveland Clinic is a non-profit academic medical center. Advertising on our site helps support our mission. We do not endorse non-Cleveland Clinic products or services. Policy